Today Stock Market Update:-The Indian stock market witnessed a highly volatile trading session on 21st July 2025, opening in the red but ending the day with marginal gains. While global markets touched all-time highs, Indian indices struggled amid mixed sentiments and fluctuating investor confidence.

📊 Major Index Performance in Today Stock Market Update

- S&P BSE Sensex closed at 82,200.34, up by 442.61 points (0.54%)

- Nifty 50 ended at 25,090.70, gaining 122.30 points (0.49%)

- Nifty Bank surged to 56,952.75, marking an increase of 669.75 points (1.19%)

Despite today’s green close, the broader sentiment remained cautious due to subdued Q1 earnings from top companies like HDFC Bank and ICICI Bank.

📈 Top Gainers Today

| Company | Price | % Gain |

|---|---|---|

| Eternal | ₹271.70 | 5.64% |

| ICICI Bank | ₹1,465.80 | 2.81% |

| HDFC Bank | ₹2,000.50 | 2.20% |

| HDFC Life | ₹752.30 | 1.73% |

| M&M | ₹3,246.70 | 1.70% |

📉 Top Losers Today

| Company | Price | % Loss |

|---|---|---|

| Reliance | ₹1,428.60 | -3.21% |

| Wipro | ₹260.35 | -2.47% |

| IndusInd Bank | ₹858.80 | -1.29% |

| Eicher Motors | ₹5,558.00 | -1.24% |

| HCL Tech | ₹1,530.40 | -1.19% |

🌍 Global Market Pressure but Indian Market Holds Ground

While global indices like the S&P 500 posted over 80% declines during today’s trading, Indian markets showed resilience. Analysts believe that the recent disappointment in earnings by key Indian companies was already priced in by the market in the previous sessions.

📰 Key Factors Driving Market Sentiment

- 📉 Q1 Results Disappointment: Despite quarterly results from ICICI Bank and HDFC Bank, the figures were below investor expectations.

- ⚖️ Fed Rate Cut Hopes: U.S. Federal Reserve officials hinted at possible rate cuts in the upcoming meeting (July 29–30, 2025), fueling mild optimism.

- 🌐 Tariff Deal Uncertainty: The final deadline for the U.S.-China tariff deal is August 1, 2025. So far, markets haven’t reacted sharply, considering it as a common narrative under President Triumph’s administration.

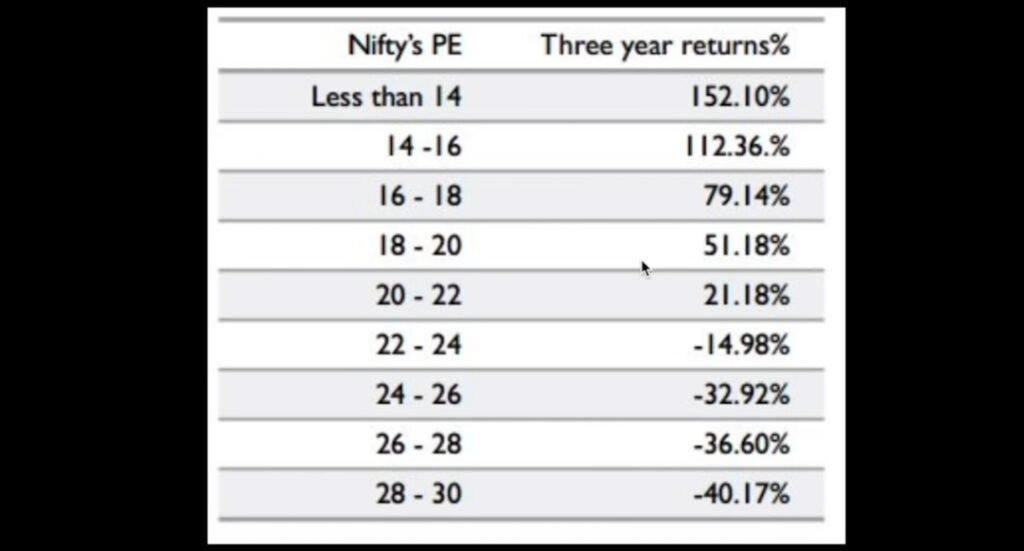

📊 Nifty’s PE Ratio and 3-Year Returns Insights – Today Stock Market Update

Based on historical Nifty PE ratio data:

- When Nifty’s PE was below 14, the 3-year return was 152.10%.

- When PE ranged between 28–30, the 3-year return dropped to -40.17%.

Insight: Higher PE valuations usually translate to lower forward returns, indicating that caution is required for long-term investors at elevated valuation levels.

🔮 What to Expect Ahead?

If the Federal Reserve announces rate cuts in its July-end meeting, markets could rally further. However, global uncertainties, earnings disappointment, and high valuations still pose risks.

📌 Conclusion – Today Stock Market Update

The Today Stock Market Update for 21 July 2025 reflects a market trying to stabilize amid global sell-offs, disappointing earnings, and anticipation over upcoming macroeconomic events. Investors should remain cautious but alert, as the direction from the Fed and global policy changes could dictate the next big move in the Indian stock markets.

Please Follow the APNEWSHUB website for more updates

Please Follow the Our WhatsApp Channel Click here for More Updates